Farm equipment depreciation calculator

MACRS Depreciation Calculator Based on IRS Publication 946 Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate. There are many variables which can affect an items life expectancy that should be taken into consideration.

Broilers Project Reports Poultry Poultry Business Poultry Farm

The calculator should be used as a general guide only.

. Section 179 Tax Deduction for Farm in California. Depreciation rate finder and calculator You can use this tool to. The MACRS Depreciation Calculator uses the following basic formula.

California has very specific rules pertaining to depreciation and limits any Section 179 to 25000 Maximum per year. Farm buildings can be written off over either 10 or 20 years depending on what theyre used for. Rental Force is the best place to find equipment rentals in Whitingham VT.

Central Ohio Bag. The average Equipment Operator salary in Whitingham VT is 44516 as of but the salary range typically falls between 36922 and 54043. If Bob elects to use 150 percent-declining balance then his first year allowed.

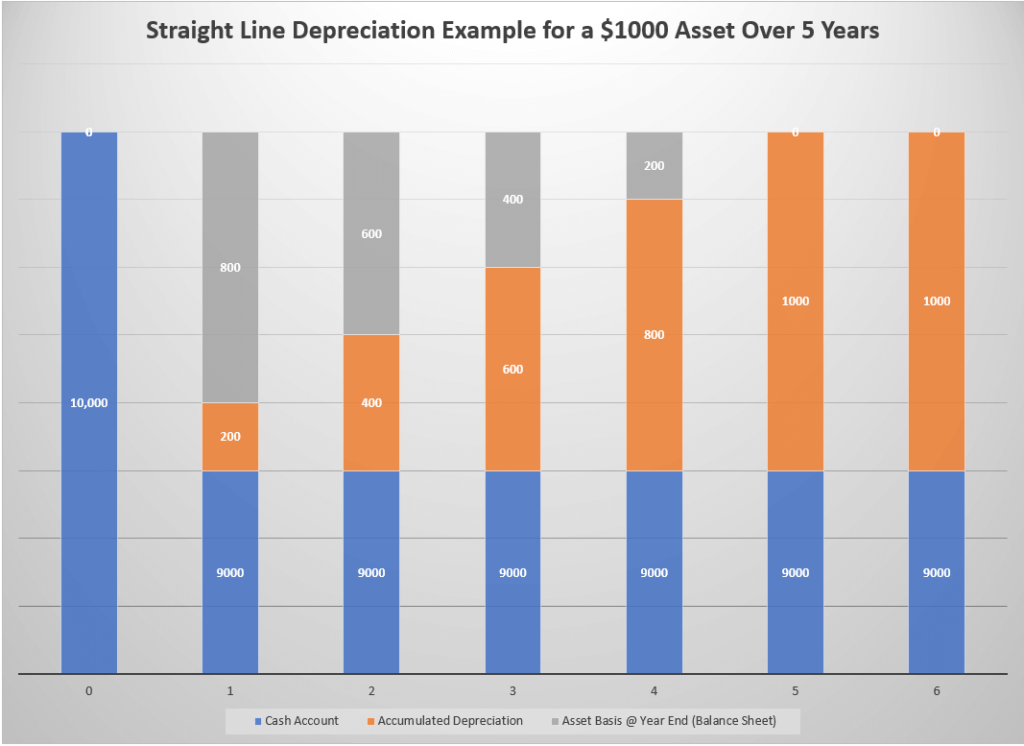

Farm equipment depreciation calculator Minggu 04 September 2022 Depreciation is the allocation of cost of an asset among the time periods when the asset is used. Land improvements drain tiles and berms for example can be depreciated. The average Farm Worker salary in Whitingham Vermont is 34938 as of January 27 2022 but the salary range typically falls between 30011 and 39941.

I attended a liquidation auction held by fleet vehicle and it was run so smooth that I picked up at a business card and gave it to my boss. In this example total annual ownership cost is 7060 sum of depreciation 3985 interest 1196 TIH. You must add otherwise allowable depreciation on the equipment during the period of construction to the basis of your improvements.

Bobs default depreciation will be 200 percent-declining balance which in the first year is 8000 40000 x 020. Next youll divide each years digit by the sum. See Uniform Capitalization Rules in Pub.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. The first step to figuring out the depreciation rate is to add up all the digits in the number seven. You can send us comments through IRSgovFormCommentsOr you can.

Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value. 7 6 5 4 3 2 1 28. Salary ranges can vary widely depending on many.

Total annual ownership cost is the sum of depreciation interest and TIH. We welcome your comments about this publication and suggestions for future editions. In other words the.

The Silver Lining To Used Equipment Prices Farming Organic Farm Farmers Farmersmarket Agriculture Ou Successful Farming American Agriculture Agriculture

Depreciation Formula Calculate Depreciation Expense

Pp E Property Plant Equipment Overview Formula Examples

How To Calculate Depreciation Expense For Business

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Formula Calculate Depreciation Expense

Depreciation And Farm Machinery A Rule Of Thumb Grainews

What Is Equipment Depreciation And How To Calculate It

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Rate Formula Examples How To Calculate

Get Professional Balance Sheet Template Balance Sheet Template Spreadsheet Template Project Management Templates

Depreciation Formula Calculate Depreciation Expense

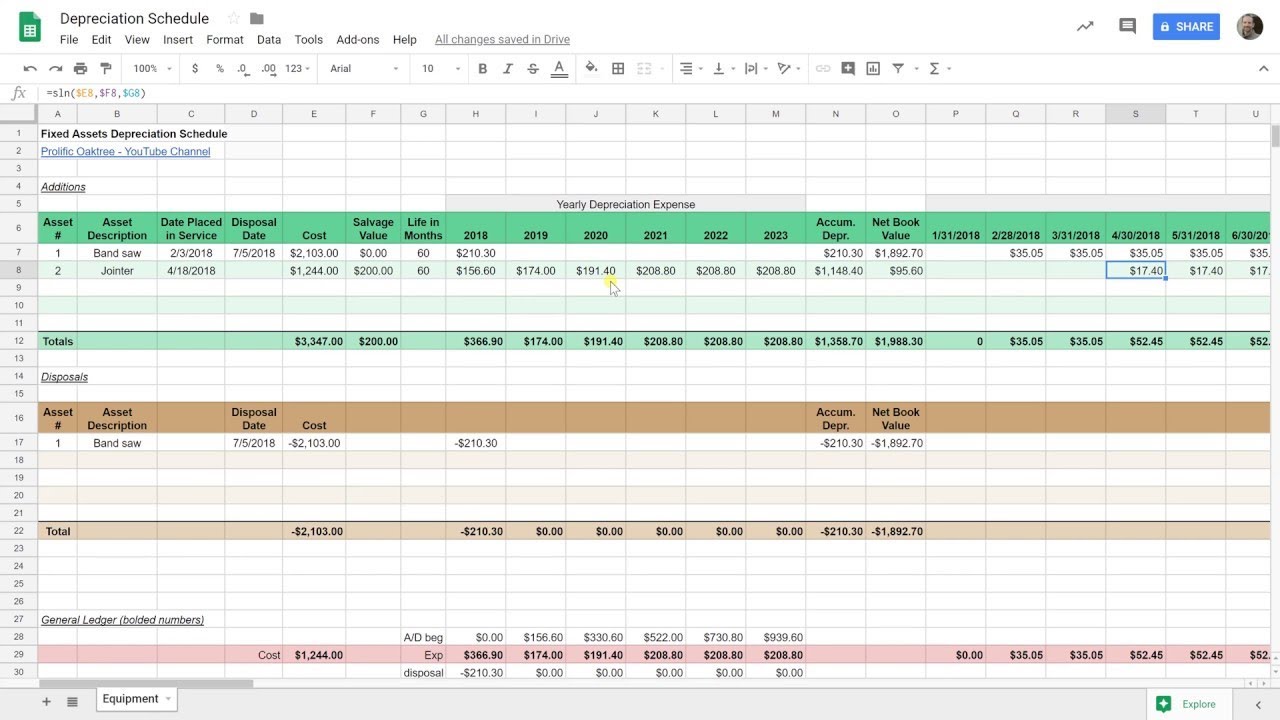

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Accelerated Depreciation And Machinery Purchases Farmdoc Daily

Pin On Agricultural Machinery